India has modernised credit rails. But recovery is still manual, manpower-heavy, and inefficient by design. This mismatch will define credit risk in the next 3 years. India has built something extraordinary in credit. In a decade, lending has moved from branch-led paperwork to real-time, digitally underwritten, API-driven distribution. Digital lending volumes grew 251% between FY22… Continue reading You cannot hire your way out of debt recovery — not at India’s scale.

Blog

How AA Is Transforming MSME Lending: Adoption Trends and Portfolio Intelligence

The Account Aggregator (AA) framework is rapidly emerging as one of the most impactful digital public infrastructure layers in India’s lending ecosystem. For lenders serving sole proprietors, small merchants, gig workers and micro-enterprises, cash-flow visibility is the foundation of risk assessment. Bank statements and GST data remain the richest sources of truth — and how… Continue reading How AA Is Transforming MSME Lending: Adoption Trends and Portfolio Intelligence

Ignosis Raises $4M Led by Peak XV’s Surge to Democratise Financial Data & Inclusion in India with DPI Rails and AI-Driven Analytics

In just three years, Ignosis has earned the trust of 125+ financial institutions — enabling access to credit, insurance, and investments through hyper-personalised, AI-driven financial intelligence. Ahmedabad, September 30, 2025: Ignosis (https://ignosis.ai), India’s leading enterprise-first Account Aggregator (AA) infrastructure and financial data intelligence platform, has raised $4 million in its Pre-Series A round led by Peak XV’s Surge,… Continue reading Ignosis Raises $4M Led by Peak XV’s Surge to Democratise Financial Data & Inclusion in India with DPI Rails and AI-Driven Analytics

The Rise of PDF Frauds in Financial Data Sourcing — and Why Account Aggregator (AA) Is the Way Forward

Banks, NBFCs, and fintech lenders have relied on PDF parsing engines to extract data from customer-submitted bank statements, salary slips, ITRs, and investment proofs. These parsed insights power critical credit decisions — average balances, EMI outflows, salary credits — forming the backbone of underwriting journeys. But this dependency has created a glaring vulnerability: when the… Continue reading The Rise of PDF Frauds in Financial Data Sourcing — and Why Account Aggregator (AA) Is the Way Forward

The AA Advantage: Automating SEBI Prohibition of Insider Trading Compliance for a Frictionless Future

Indian financial compliance teams face a considerable challenge in managing employee investment disclosures to comply with SEBI’s PIT Regulations, designed to prevent insider trading. The conventional method, relying on manual spreadsheets and self-reported data, burdens employees, who already dedicate significant time to information management, and introduces inefficiencies and potential inaccuracies for compliance in this critical… Continue reading The AA Advantage: Automating SEBI Prohibition of Insider Trading Compliance for a Frictionless Future

AA Orchestration: The Strategic Imperative for BFSI

As India’s digital financial infrastructure evolves, the Account Aggregator (AA) framework has emerged as a transformative force, enabling secure, consent-driven sharing of financial data between Financial Information Providers (FIPs) such as banks and Financial Information Users (FIUs) like lenders or wealth advisors. However, to realize the true scale and efficiency of this ecosystem, a critical… Continue reading AA Orchestration: The Strategic Imperative for BFSI

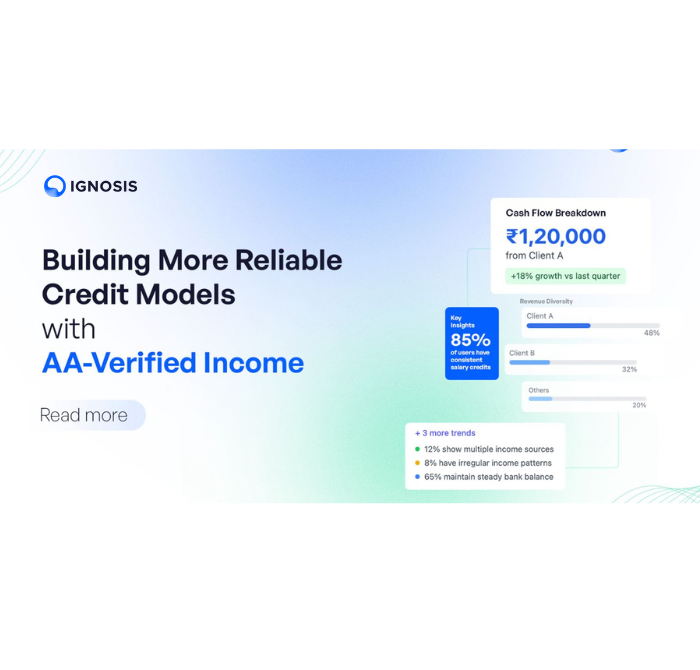

Building More Reliable Credit Models with AA-Verified Income

For years, India’s lending industry has prioritized speed—fast approvals, seamless onboarding, and instant disbursals. However, this rapid expansion has exposed critical flaws in risk assessment, leading to rising defaults and worsening Non-Performing Assets (NPAs). The Need for Reliable Income Assessment Traditionally, lenders have relied on imputed income models to evaluate a borrower’s repayment capacity. These… Continue reading Building More Reliable Credit Models with AA-Verified Income

How Tech Is Changing Loan Collections?

Fintechs and banking sectors are quick to adapt to new technologies, owing to these advancements. Debt collection, which was once seen as a hard and time-consuming task involving repeated phone calls and mailing letters, has now completely transformed as companies optimize digital channels, improve the consumer experience, and tailor the customer journey with the use… Continue reading How Tech Is Changing Loan Collections?

Role of AA In Financial Planning And Wealth Management

Massive disruption brought on by digital technology is changing the way we work and conduct business in every industry. Companies who are well-positioned to capitalise on the trend toward remote working, digital payments, and online purchases are witnessing significant revenue growth, often at the expense of incumbents that are slower and less agile in their… Continue reading Role of AA In Financial Planning And Wealth Management

Collections Efficiency: The Playbook to Combine the Best of AI and Human Intelligence

To argue that present debt collection techniques have an image problem is an understatement of their negative connotation. Threatening, harassing phone calls, coercion for money, or, in more serious circumstances, fraud, hounding, and social humiliation If a borrower fails on a loan, this is all part of the deal. A short glance at the Reserve… Continue reading Collections Efficiency: The Playbook to Combine the Best of AI and Human Intelligence